Hotel Staff and Payroll Scheduling

Purpose of The PayrollPayroll employees calculate the pay rate with the hours worked to do the payroll so paychecks are re... SchedulingA process in which the appropriate number of employees are as-signed to full fill necessary duties a... :

The SOP (Standard Operating Procedure) for Finance and Accounting – Payroll Scheduling and approval is a crucial document that outlines the steps and guidelines that need to be followed when processing employee salaries. This document includes information on how to schedule the payroll, the various factors that need to be taken into consideration, and how to get the necessary approvals.

The payroll process is an essential part of any organization, and it is important to ensure that it is carried out accurately and efficiently. The SOP provides a framework for managing the payroll system, which includes setting up a payroll schedule, calculating salaries, and ensuring that all necessary approvals are obtained.

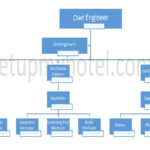

The SOP also outlines the roles and responsibilities of the various stakeholders involved in the payroll process. This includes the payroll team, HR department, and managers who are responsible for approving the payments. By clearly defining these roles and responsibilities, the SOP helps to minimize errors and ensure that everyone is aware of their obligations.

In addition, the SOP also includes information on the various laws and regulations that need to be followed when processing employee salaries. This includes tax laws, labor laws, and other regulations that may apply to the organization.

Overall, the SOP for Finance and Accounting – Payroll Scheduling & Approval is an essential document that helps to ensure the smooth and efficient operation of the payroll system. By following the guidelines outlined in the SOP, organizations can ensure that their employees are paid accurately and on time, while also complying with all relevant laws and regulations.

All employees will be scheduled for work based on staffing guidelines approved by the Executive Vice President of Operations. It is the responsibility of the General ManagerManager is a person in the hotel operations who is assigned to manage or supervise a group of employ... and ControllerThe financial Controller�manager is in charge of all accounting functions of a hotel. Duties inclu... to establish compliance with these minimum standards.

Payroll Scheduling SOP Procedures:

MANUAL TIME CLOCK PROPERTIES

1. Staffing guidelines should be on file for each position.

2. Schedules should be done each week using the staffing guidelines and adjusting them to the weekly forecast. They should be posted by Thursday of each week. The schedules should be costed and entered into the proper area of the Payroll form. (See attached). They should then be approved by the Executive Committee member or the General Manager.

3. Daily time cards should be audited to ensure employees are working their schedule and not “riding” the clock. Also, late punches should be noted for disciplinary purposes. Pending overtime should also be monitored.

4. The actual hours should be entered into the proper area of the Payroll form. Also, business levels should be monitored and schedules be adjusted accordingly. If business is not as forecast. staff should be sent home wherever possible.

5. At the end of the week the Payroll should be calculated and compared to the schedule. Variances must be explained.

AUTOMATED TIME CLOCK PROPERTIES

1. Staffing guidelines should be on file for each position.

2. Schedules should be done each week using the staffing guidelines and adjusting them to the weekly forecast. They should be posted by Thursday of each week. The schedules should be entered into the time clock system and costed reports printed and approved by Executive Committee members or General Manager. At no time should “open” schedules be permitted.

3. Daily Hours Reports should be audited to ensure employees are working their schedule and no punches are missed. Also. business levels should be monitored and schedules be adjusted accordingly. If business is not as forecast, staff should be sent home wherever possible.

4. Daily ReportsDaily Reports� is a�set of reports prepared for Management by the midnight shift daily. These re... for tardiness, approaching overtime, missed punches, etc., should be reviewed and proper action taken.

5. At the end of the week the payroll should be calculated and compared to the schedule. Variances must be explained.

Training Summary Questions:

Q1. Who approves the work schedule based on staffing guidelines?

Q2. What are the two clock properties?

Q3. Who is responsible for establishing compliance with these minimum standards?

Q4. When should be payroll calculated and compared to the schedule?

Patreon Only SOP Download

SOP Number: Finance and Accounting SOP – 19 Department: Payroll Date Issued: 8-Aug-2021 Time to Train: 25 Minutes