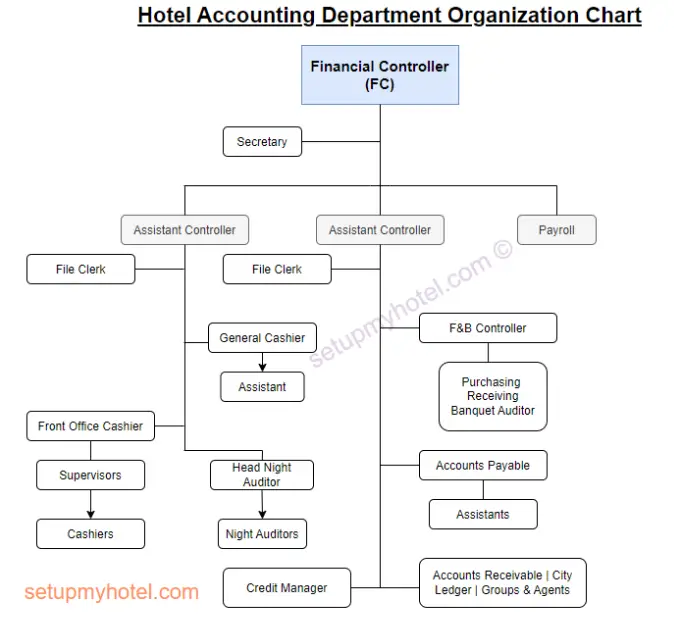

Hotel Accounting Department Organization Chart

Hotel Accounting Department Organization Chart The hotel accounting department plays a crucial role in the financial management of a hotel. ...

Read more

Hotel Credit Manager / Credit Controller Job Description

Job Description, Duties, Interview Questions and Salary For Credit Manager / Credit Controller The role of a Hotel Credit Manager/Credit ...

Read more

How To Reduce Skipping (Non Paying) Guest In Restaurants?

How to Reduce Skipping (non-paying) guests in Restaurants? Reducing the number of non-paying guests, commonly referred to as “skipping” or ...

Read more

Guidelines for Handling Credit Cards

Handling Credit Cards Credit cards are an essential tool for managing personal finances. However, they can also be a source ...

Read more

Front Office – Guest Dispute / Allowance Voucher Format

Allowance Voucher Format Sample Allowance Voucher Format DATE: Guest Name:_________________ Room no.:____________________ ...

Read more

SOP Finance and Accounting – Credit Policy And Direct Billing Authorization Process

Credit Policy And Direct Billing Authorization Process The SOP (Standard Operating Procedure) for finance and accounting regarding credit policy and ...

Read more

SOP – Front Office – Bill to company or Direct billing

Standard Procedure for Bill to company or Direct billing Check out To establish procedures for the approval of bills to ...

Read more

SOP – Banquets – Bill Preparation And Settlement

Bill Preparation and Settlement in Banquets A guest might settle the banquet bill by any of the below-accepted methods of ...

Read more